Prepare for Healthcare Reform

Marketplace Opens Oct. 1

HALEY FOLLETT

THE SIGNAL

In January 2014 the long-awaited Patient Protection and Affordable Care Act, also known as ObamaCare, goes into effect. In preparation, the Health Insurance Marketplace, the new way to find, compare and buy insurance, will open Oct. 1.

The Marketplace was designed to help uninsured citizens find insurance at an affordable price. It is also a source for those who have insurance but want to look at what else may be available to them.

“There will be plans to fit just about every need and budget,” said a customer service representative for the Marketplace.

UHCL full-time faculty and staff will see few changes come 2014. United Healthcare, the university’s health insurance provider, has already included many of the changes in its plan including: dependent(s) up to 25 years of age, preventative care and coverage of pre-existing conditions.

The primary reason why the changes will not greatly affect the staff is because of a change that occurred Sept. 1. This change considers employees who work 30 hours a week for more than four and a half months to be full-time employees.

Even with a full-time employee being 100 percent covered, the price of healthcare quickly adds up when covering any dependents the employee may have. These employees may want to look into acquiring insurance from the Marketplace to possibly find a cheaper insurance carrier to cover their dependents.

“If they can qualify for the assistance or a cheaper plan through the Affordable Care Act, that may be an option for some of our employees,” said Erica De Leon, benefits coordinator for the Office of Human Resources. “Maybe not for their personal coverage but for their dependents.”

With 2014 quickly approaching, students also need to start looking into what insurance options they might have. Being a student is not an automatic exemption from needing insurance.

As part of the changes brought by the Affordable Care Act, students 25 years old or younger will be able to stay on their parents’ insurance until their 26th birthday. For students who do not have insurance through their parents or place of employment, there are two options available: Marketplace and Student Health Insurance.

Marketplace will be open to students as it will be to everyone else searching for insurance. Any student or person with income below the amount required to file taxes will not be required to obtain insurance, because they fall into one of the exempt categories.

UHCL offers its students the option of purchasing the AIG Student Health Insurance plan. This policy is a non-renewable one-year term insurance plan purchased through the school from the AIG insurance company. The insurance can be purchased for the whole year or by semester.

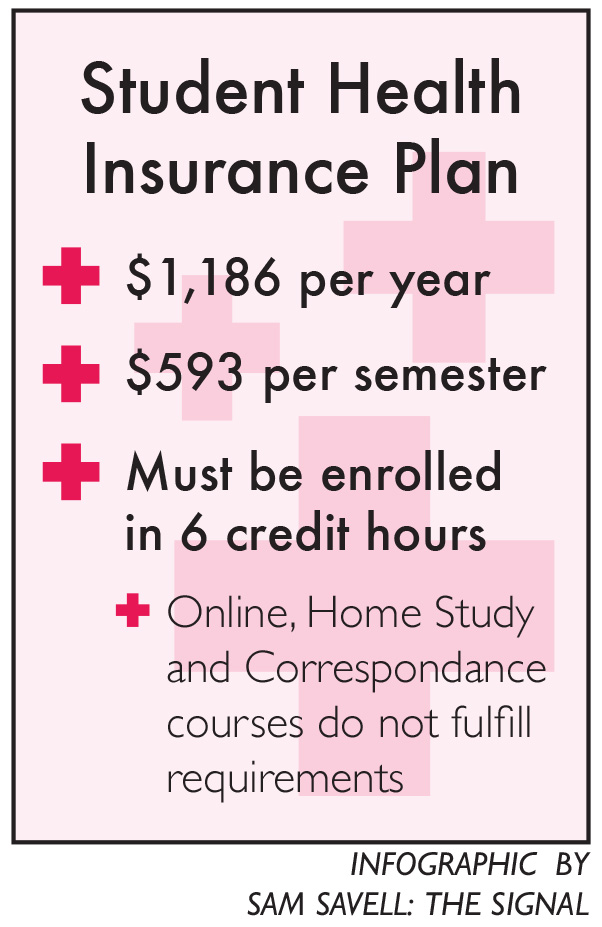

The cost for the full 2013-2014 school year is currently $1,186. If purchased for fall or spring only, the cost is $593 per semester.

Students must be enrolled in at least six credit hours to be eligible for the Student Health Insurance Plan. Home study, correspondence, television and online classes do not fulfill the requirement for credit hours.

“The benefit for having the AIG insurance is that students who come to this campus can come to us and see our doctor for $2 versus $15,” said Regina Pickett, director of UHCL Health Services and family health specialist. “They can come and get blood work done no matter what is ordered for $10 versus $70-150. They have access to free nursing as long as we are open, Monday-Friday. They have over-the-counter medications that are free. We are their referral source. We have a class D pharmacy on campus where students can get their birth control or anti-inflammatory.”

There are still many things unknown about the future of healthcare and what the Affordable Care Act will bring in the years to come. For now one thing is certain: unless exempt, beginning January 2014 everyone is required to have insurance. The penalty for someone who can afford health insurance, but does not have coverage beginning January 2014, will be 1 percent of his/her yearly income or $95, whichever is higher. This penalty fee will increase every year. By the year 2016 the penalty for not having insurance is estimated at $695, or 2.5 percent of the income.

“People without health coverage will also have to pay the entire cost of all their medical care,” HealthCare.gov stated on its website. “They won’t be protected from the kind of very high medical bills that can sometimes lead to bankruptcy.”

For more information on the Health Insurance Marketplace, visit https://www.healthcare.gov/marketplace/individual.

For more information on faculty and staff insurance, there will be a presentation Wednesday, Oct. 9, at 9 a.m. and again at noon in Bayou Building, Room 3332.

For more information on the Student Health Insurance, call 888-560-7427, or stop by the Office of Health Services in the Student Services Building, Room 1.301 to pick up a packet.