COMMENTARY: Get with the flow and dispose of the ‘tampon tax’

UPDATE: 6/30/19 – The article has been updated in the second paragraph with the words “tampon tax” in place of the term “pink tax.”

“If women’s health took a backseat to general health, then menstrual health isn’t even in the car.” – Linda B. Rosenthal

Texas needs to join the other nine states in the movement to stop taxing feminine hygiene products such as tampons, sanitary napkins and menstrual cups. Texas also needs to take the lead alongside states like New York and Illinois in making these goods accessible in the form of stocked free supplies in public spaces.

The taxation of a hygiene product required by over half of Texans for over half of their life is both discriminatory and absurd. The “tampon tax” targets women and some transgender men exclusively for something that is a bodily function.

The United States has come a long way in providing access to necessities like toilet paper and running water in public spaces, however, improvements to women’s health and menstrual equity are continuously behind the curve.

After 2015 FEMA added feminine hygiene products as being eligible to be purchased through grants. It wasn’t until 2017 that a law was passed making menstrual products free to all federal prisoners.

A viral video of Rep. Sean Patrick Maloney surfaced explaining how his purchase of menstrual products for his staff and guests were considered “personal care” items by the finance office of the Committee on House Administration. Therefore, he would not be reimbursed for those purchases but would be for other supplies such as paper towels, Band-aids and hand sanitizer.

By providing a tax exemption to consumers for menstrual products and free access to them via public institutions, we can provide menstrual equity to all who have periods despite class or race.

The basics

Often times the ‘‘pink tax’’ is used interchangeably with the “tampon tax,” but technically this phrase is specific to the higher cost of items marketed towards women. The price difference between “pink’’ vs “blue” items, such as razors or shaving cream varies even though they are the same thing.

This is problematic, but currently, price gouging occurs on the basis of gender and it is not equitable to the “tampon tax.”

The “tampon tax” is not an additive or special tax, but rather the practice of including menstrual items as a taxable item. The call for the end of the “tampon tax” is to essentially relabel the items as a “need” rather than a “non-essential” item.

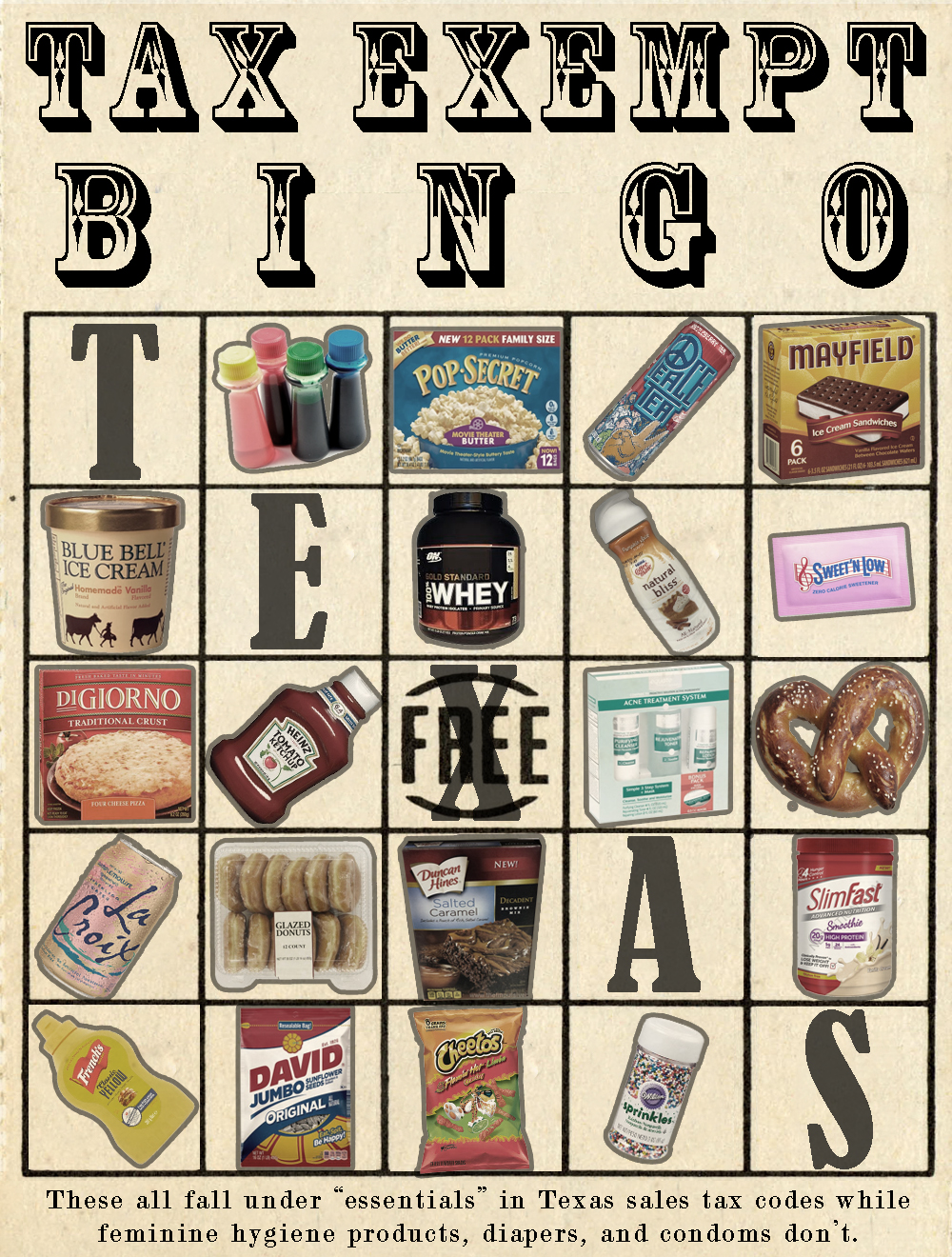

Texas has a slew of products exempt from taxation and considered “necessities” such as groceries and over-the-counter (OTC) drugs.

Though there is an argument for classifying feminine hygiene products as OTC medicine, so it tax-exempt, this can further add to existing taboos on women menstruating. Having a regular period alone is not a sickness and merely changing the label for that is harmful.

Another current legal loophole preventing Texas from adding menstrual products to the list of exemptions is the exclusion of a “Drug Facts” label. This label assigned by the FDA allows items to be added to Texas’ exemption list. As of right now, there is no law that requires the manufactures to disclose the ingredients.

The economics

Being in a fiscally conservative Texas, the economics of the conversation must be at the forefront of the conversation for any meaningful change. This is especially true as sales tax is one of the primary sources of revenue that contributes to the state budget.

The estimated 40 million dollars in tax revenue that Texas would lose if feminine hygiene products were no longer taxed is a point of concern. However, this loss can be mitigated or avoided entirely in several ways such as replacing the “tampon tax” with a less discriminatory exemption, expanding the “sin taxes” and buying them wholesale.

Ice cream, food coloring and popcorn are all exempt from sales tax and can be used to offset exemptions given to menstrual products. Taxing e-cigarettes as a “sin tax” and expanding cannabis laws to include taxable recreational use can make up lost revenue.

Negotiating the best wholesale price to stock public spaces will offset a considerable amount of the cost too. Indirect economic benefits of getting rid of the ‘tampon-tax’ and providing access to those products in public institutions would bring a productive, focused and healthy community.

The increased productivity and focus would come from making access to these necessities one less thing to worry about for poor students, as well as people trying to rebuild their lives in shelters, temporary living situations or homelessness.

Over 20 percent of Texas children live in poverty. Many think that missing school because a child is on her period is something only found in third world countries, however, days of education are lost because families do not have the funds to support this basic need. A poor education has rippling effects to the economy on the large scale.

A community that is not in need of feminine hygiene products can cut expensive health services down the road like the treatment of bacterial infections.

Many supporters of enhancing access to menstrual products have also suggested offering tax incentives to employers who provide these products for their employees while on the job, or passing legislation making it a requirement of businesses that reach a workforce of at least 100.

What can be done now?

Changes happen over time, but luckily other states have already taken legislative measures to improve the lives of women and transgender men in the menstruation department. Decades of activists, writers, teachers and filmmakers have made the conversations a bit easier by lessening the taboo of menstruation.

The Texas legislature needs bills to be introduced and passed, like SB 129, HB 219 or HB 162, that would exempt tampons, napkins and menstrual cups from sales tax. In addition, bills should provide a budget for free feminine hygiene products to be stocked in all public institutions including schools, libraries, government offices, state-run shelters, etc.

Voicing your opinions via letters and calls to your representatives is the first step to change. In your local communities, participate in events such as open-forums and town halls. UHCL, for example, has various ways for students to voice their needs like the Student Government Association (SGA.)

Almost as important is making sure that women are a part of these conversations at all levels. As the patriot slogan goes, “no taxation without representation.”

If you have the ability to donate products, look first to low-income schools, libraries, shelters and community centers. Also, be on the alert for campaigns such as #EndPeriodPoverty, “I Support The Girls” and #HappyPeriod.

If you find yourself in need of menstrual products on campus, the Office of Diversity, Equity, and Inclusion, the Health Center and the food pantry, organized by the Dean of Students through continual donations, have them available.